Introduction

Electronic invoicing, or e-invoicing, has been gaining momentum worldwide in recent years due to its ability to streamline business operations and increase efficiency. With the global pandemic accelerating digital transformation, more and more countries are implementing e-invoicing as a way to automate and digitize their financial processes.

In 2023, e-invoicing is expected to become even more widespread, with new regulations and standards being introduced to ensure that businesses can take full advantage of its benefits. In this blog, we’ll take a closer look at everything you need to know about e-invoicing in 2023.

Contents:

- What is E-invoicing?

- Recent News

- What is E-invoicing under GST?

- Why is E-invoicing important?

- E-invoicing regulations in 2023

- E-invoicing software in 2023

- Who must generate the E-invoice and its Applicability in India?

- Systems before & after E-invoicing

- Process of getting an E-invoice

- Time Limit to Generate E-invoice

- Benefits of E-Invoicing to Businesses

What is E-invoicing?

E-invoicing is the process of sending and receiving invoices electronically between businesses, using structured data formats that can be read by machines. This eliminates the need for paper-based invoices, which can be time-consuming and prone to errors. E-invoicing can be implemented in various ways, including through a web portal, email, or directly from one accounting system to another.

In e-invoicing, businesses must generate e-invoices for B2B(Business-to-Business) transactions. GrossAccount helps you to generate E-Invoice with email. We provide the best customizable accounting software with features of Invoice, stock management, and accurate business reports with our billing software.

Recent News:

From 1st May 2023, taxpayers with an annual turnover equal to or exceeding Rs. 100 crores must report tax invoices and credit-debit notes to IRP within 7 days of the invoice date, according to GST network advisories dated 12th April 2023 and 13th April 2023.

What is E-invoicing under GST?

E-invoicing under GST (Goods and Services Tax) is a system of electronically generating invoices for business-to-business (B2B) transactions. It was introduced by the Indian government to improve tax compliance and simplify the invoicing process for businesses.

The GST Council decided to implement an e-invoicing system in its 35th meeting, covering several specific categories of people, mostly large companies. Later, the program was expanded to include medium and small businesses.

The concept of e-invoicing is not the generation of invoices on the GST portal, but the submission of an already generated standard invoice to a common e-invoice portal. This facilitates multipurpose reporting with just one-time input of invoice details.

Under the e-invoicing system, businesses are required to generate a standardized electronic invoice format called an Invoice Reference Number (IRN) for each invoice issued. This IRN is unique to each invoice and is generated by the GST Network (GSTN) after verifying the invoice details provided by the business.

The e-invoicing system is integrated with the GST portal and is mandatory for businesses with an annual turnover of Rs. 500 crores or more. It helps businesses avoid errors and discrepancies in invoicing, as well as reduce the time and cost associated with traditional paper-based invoicing methods.

Why is E-invoicing important?

E-invoicing offers several advantages over traditional paper-based invoicing, including:

Increased efficiency

E-invoicing eliminates the need for manual data entry and reduces the risk of errors, resulting in faster processing times and improved accuracy.

Cost savings

E-invoicing can reduce the cost of paper-based invoicing, including printing, postage, and storage.

Improved cash flow

E-invoicing can speed up the payment process, resulting in improved cash flow for businesses.

Reduced environmental impact

E-invoicing eliminates the need for paper-based invoices, reducing the environmental impact of invoicing.

Improved tax compliance

E-invoicing can help businesses comply with tax regulations, reducing the risk of penalties and fines.

Transparency

E-invoicing provides greater transparency into financial transactions, reducing the risk of fraud and corruption.

E-invoicing regulations in 2023

Europe: The European Union is implementing the European E-invoicing Standard, which aims to establish a common e-invoicing format across all member states.

Asia-Pacific: Several countries in the Asia-Pacific region, including China, India, and Singapore, are implementing e-invoicing regulations to improve tax compliance and increase efficiency.

Latin America: Countries in Latin America, including Mexico and Brazil, are implementing e-invoicing regulations to combat tax fraud and improve efficiency.

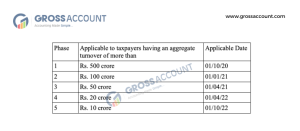

E-invoicing regulations in India in 2023

The Indian government introduced e-invoicing regulations in 2020, mandating e-invoicing for businesses with a turnover of INR 500 crore or more. In 2023, the government is expected to expand the scope of e-invoicing to include businesses with a lower turnover. Additionally, the government is expected to introduce new regulations to improve the adoption of e-invoicing, including:

Simplified invoicing: The government is expected to introduce simplified invoicing rules to make it easier for businesses to adopt e-invoicing.

E-invoicing for exports: The government is expected to introduce e-invoicing for exports to improve the efficiency of cross-border transactions.

E-invoicing for B2C transactions: The government is expected to introduce e-invoicing for B2C transactions to improve tax compliance in the retail sector.

E-invoicing software in 2023

As e-invoicing becomes more widespread, the demand for e-invoicing software is expected to increase. In 2023, businesses can expect to see more advanced e-invoicing software that offers features such as:

1) Automatic invoice matching

E-invoicing software can automatically match incoming invoices with purchase orders and other documents, reducing the need for manual intervention.

2) Mobile invoicing

E-invoicing software that can be accessed on mobile devices will become increasingly popular, allowing businesses to send and receive invoices on the go.

3) Artificial intelligence

E-invoicing software that uses artificial intelligence to extract data from invoices and automatically categorize expenses will become more common.

4) Integration with accounting software

E-invoicing software that can integrate with accounting software will become more common, making it easier for businesses to manage their finances.

Who must generate the E-invoice and its Applicability in India?

It’s important to note that e-invoicing is only applicable for transactions falling under the GST regime. Transactions involving non-GST goods or services, such as alcohol, petrol, diesel, and natural gas, are currently exempt from e-invoicing.

Systems before & after E-invoicing

Before e-invoicing, businesses typically used paper-based systems for invoicing. This process involved printing out invoices, filling in the necessary details manually, and then sending them through the mail or delivering them in person to customers or by using some ERP software. This process was time-consuming, error-prone, and required significant manual labour.

After e-invoicing was introduced, businesses were able to automate their invoicing processes. E-invoicing involves the use of electronic documents to send and receive invoices between businesses and customers. The entire process is done electronically, from generating the invoice to sending it to the customer and receiving payment.

E-invoicing has many benefits over paper-based invoicing systems. It is faster, more accurate, and more efficient than paper-based invoicing. It generates GSTR-1 reports and reduces the time it takes to create and send invoices, which can speed up the payment process and improve cash flow. It also reduces the risk of errors that can occur in manual data entry.

Furthermore, e-invoicing can help businesses save money on printing, postage, and other related expenses. It also reduces the environmental impact of paper-based invoicing, as it eliminates the need for paper, ink, and other resources associated with printing and mailing paper invoices.

Process of getting an e-invoice

The process of getting an e-invoice may vary depending on the country and the system used by the particular company or organization that you are dealing with. However, here are some general steps you can take to obtain an e-invoice:

Check if the company or organization offers e-invoicing

Register for e-invoicing: If e-invoicing is available, you will need to register for it. This may involve creating an account or providing your contact information to receive invoices electronically

Verify your information: Once you have registered for e-invoicing, you may need to verify your information with the company or organization to ensure that the invoices are sent to the correct email address or other electronic formats.

Receive e-invoices: After you have registered and verified your information, you should start receiving e-invoices instead of paper invoices. Depending on the system used by the company or organization, you may receive the e-invoice as a PDF attachment in an email, or it may be accessible through an online portal.

Pay the e-invoice: Once you receive the e-invoice, you can pay it through the payment options provided by the company or organization. This may include online payment or payment by bank transfer.

Time Limit to Generate E-invoice

GST systems and GST law have not fixed a time limit for generating e-invoices until 30th April 2023. But invoices and credit-debit notes submitted after 1st May 2023 will be considered non-compliant by the Tax department if they do not generate e-invoices within 7 days of the date of the invoice and have annual aggregate turnover(AATO) exceeding INR 100 crore.

The rest of the applicable taxpayers do not have a defined deadline or period within which they must generate e-invoices. Thus, taxpayers who file GSTR-1 returns within a week of the invoice/CDN date are advised to create e-invoices on or after that date, as it takes T+3 days for details of e-invoices to be auto-populated into the forms.

Benefits of E-Invoicing to Businesses

There are several benefits of e-invoicing to businesses, including:

Time and cost savings

E-invoicing eliminates the need for paper-based invoicing processes, which can be time-consuming and costly. With e-invoicing, businesses can create, send, and receive invoices in real time, reducing processing times and costs.

Improved efficiency

E-invoicing automates many manual processes associated with paper-based invoicing, such as data entry and invoice matching, which improves efficiency and reduces errors.

Faster payment processing

E-invoicing can help businesses get paid faster by reducing the time it takes for invoices to be processed, approved, and paid. This can improve cash flow and reduce the need for manual follow-up with customers.

Increased accuracy

E-invoicing reduces the risk of errors associated with manual data entry, such as typos or incorrect calculations, which can lead to payment delays or disputes.

Better record-keeping

E-invoicing provides a more organized and streamlined approach to invoicing and record-keeping, which can make it easier to manage and track invoices and payments.

Improved customer experience

E-invoicing can provide customers with a more convenient and efficient invoicing and payment experience, which can improve customer satisfaction and loyalty.

Conclusion

In conclusion, e-invoicing is set to become even more widespread in 2023 in India, with the Union Budget 2023 government introducing new regulations and expanding the scope of e-invoicing plus changes in the tax regime. To know more read our blog on Union Budget 2023: Key takeaways on Tax and GST proposals.

Businesses that have not yet adopted e-invoicing should start considering with GrossAccount as it is a way to streamline their financial processes and improve tax compliance.