Introduction

The 3 basic rules of accounting that will lead your accounting to manage easily and more accurately. Sometimes you heard the word golden rule or nowadays called sigma rule. Yeah! You heard it right. The golden rule meaning is the basic or main aspect of accounting.

If you want to keep your books up-to-date and accurate then follow these rules that lead your business accounts to the next level.

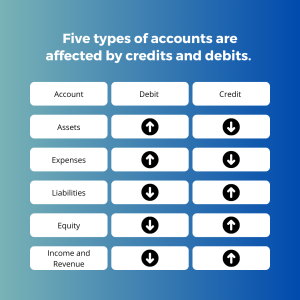

Credits and Debits are the basics of accounting. To understand the golden principle of accounting, you must recall or understand the debits and credits. A debit and a credit are equal but opposite entries in your accounting books. Five types of accounts are affected by credits and debits.

Assets

Assets are economic resources owned by a business that has value and are expected to provide future benefits. Examples of assets include cash, accounts receivable, inventory, buildings, and equipment. Debits increase assets, indicating an inflow, while credits decrease assets, representing a reduction.

Expenses

Expenses are costs made by a business in its ongoing operations to generate revenue. Examples of expenses include salaries, rent, utilities, advertising, and supplies. Debits increase expenses, while credits decrease expenses.

Liabilities

Liabilities represent the debts owed by a business to external parties. Examples of liabilities include accounts payable, loans, accrued expenses, and customer deposits. Debits decrease liabilities, while credits increase liabilities.

Equity

Equity represents the owner’s claim on the business’s assets. Debits decrease equity, representing, while credits increase equity.

Income and Revenue

Income and revenue represent the inflow of economic benefits resulting from the sale of goods, rendering of services, or other business activities. Debits decrease income and revenue, while credits increase income and revenue.

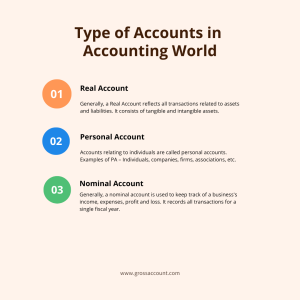

Before diving into the golden rule you need to understand the type of accounts

Type of Accounts in Accounting World

Real Account

Generally, a Real Account reflects all transactions related to assets and liabilities. It consists of tangible and intangible assets. Examples of tangible assets – are desks, chairs, buildings, machines, etc. Examples of intangible assets – are goodwill, copyrights, and patents. The balance of real accounts is carried forward to the following year, so they do not close at the end of the financial year. In addition, the balance sheet also appears in real accounts.

Personal Account

Accounts relating to individuals are called personal accounts. Examples of PA – Individuals, companies, firms, associations, etc. In a personal account, if a business or individual gives money to company A, then company A becomes the receiver and the other business becomes the giver.

Nominal Account

Generally, a nominal account is used to keep track of a business’s income, expenses, profit and loss. It records all transactions for a single fiscal or financial year. Thus, the balances are reset to zero and can be started from scratch. Interest accounts fall under the nominal account category.

3 Golden Rules of Accounting

1) Debit What Comes In, Credit What Goes Out

This rule applies to real accounts, which include assets and liabilities. It states that when there is an increase in a real account, it should be debited, and when there is a decrease, it should be credited.

An organization purchases inventory worth 1000 rupees. Because inventory is an asset, we will debit it by 1000 rupees when its value increases. On the other hand, if the business sells 500 rupees worth of inventory, we will credit the inventory account by 500 rupees, reflecting the decrease in its value.

This rule ensures that real accounts accurately reflect the changes in asset and liability values, providing a clear picture of a business’s financial position.

2) Debit the Receiver, Credit the Giver

This rule applies to personal accounts, which include individuals, organizations, or entities with whom a business has financial transactions. It states that when a business receives something, it should be debited, and when it gives something, it should be credited.

For instance, if a business receives 1,000 rupees from a customer as payment for services rendered, we will debit the accounts receivable (personal account) by 1,000 rupees. On the contrary, if the business pays 500 rupees to a supplier for goods purchased, we will credit the accounts payable (personal account) by 500 rupees.

By following this rule, personal accounts accurately reflect the amounts owed to or owed by different parties, facilitating effective tracking of transactions and outstanding balances.

3) Debit All Expenses and Losses, and Credit all Incomes and Gains

This rule applies to nominal accounts, which include income, expenses, and equity accounts. It states that all expenses and losses should be debited, while all incomes and gains should be credited.

Suppose a business use 1,000 rupees in expenses for office supplies. Since expenses represent a decrease in equity, we will debit the office supplies expense account by 1,000 rupees. Moreover, if the business earns 2,000 rupees in revenue from sales, we will credit the sales revenue account by 2,000 rupees to reflect the increase in equity.

Following this rule ensures that nominal accounts accurately capture the costs, revenues, and net profit or loss of a business, facilitating effective financial analysis and decision-making.

Conclusion

Following the three golden rules of accounting is crucial for maintaining accurate financial records. The rules provide a structured approach to recording transactions, ensuring that debits and credits are correctly applied across real, nominal, and personal accounts. By applying to these principles, businesses can analyze their financial position, make informed decisions, and fulfil reporting requirements.

It becomes increasingly necessary to have a reliable and efficient accounting software system as businesses grow and transaction volumes increase. One such solution is GrossAccount’s accounting software. It offers a user-friendly interface, robust features that simplify the recording, tracking, and analysis of financial transactions. With GrossAccount’s software, businesses can ensure compliance with the golden rules of accounting and enjoy streamlined financial management processes.

In conclusion, understanding and applying the three golden rules of accounting are fundamental for maintaining accurate financial records.

Bonus Information

Modern Rule vs Traditional Rule of Accounting

Traditional Rule of Accounting

According to the traditional rule, all expenses and losses are debited. This means that expenses are recorded on the debit side of the account. This approach emphasizes the reduction in assets or increases in liabilities resulting from expenses.

All incomes and gains are credited. This means that revenues are recorded on the credit side of the account. This approach highlights the increase in assets or decreases in liabilities resulting from revenues.

Modern Rule of Accounting

In the modern rule, expenses and losses are still recorded on the debit side of the account. However, it recognizes that expenses can also lead to a decrease in equity. Therefore, under modern rule, expenses can be debited to either expense accounts or equity accounts, depending on the nature of the expense.